October 14, 2025

Creatd’s Flyte Prepares for Strategic Growth in the Wake of Verijet’s Bankruptcy

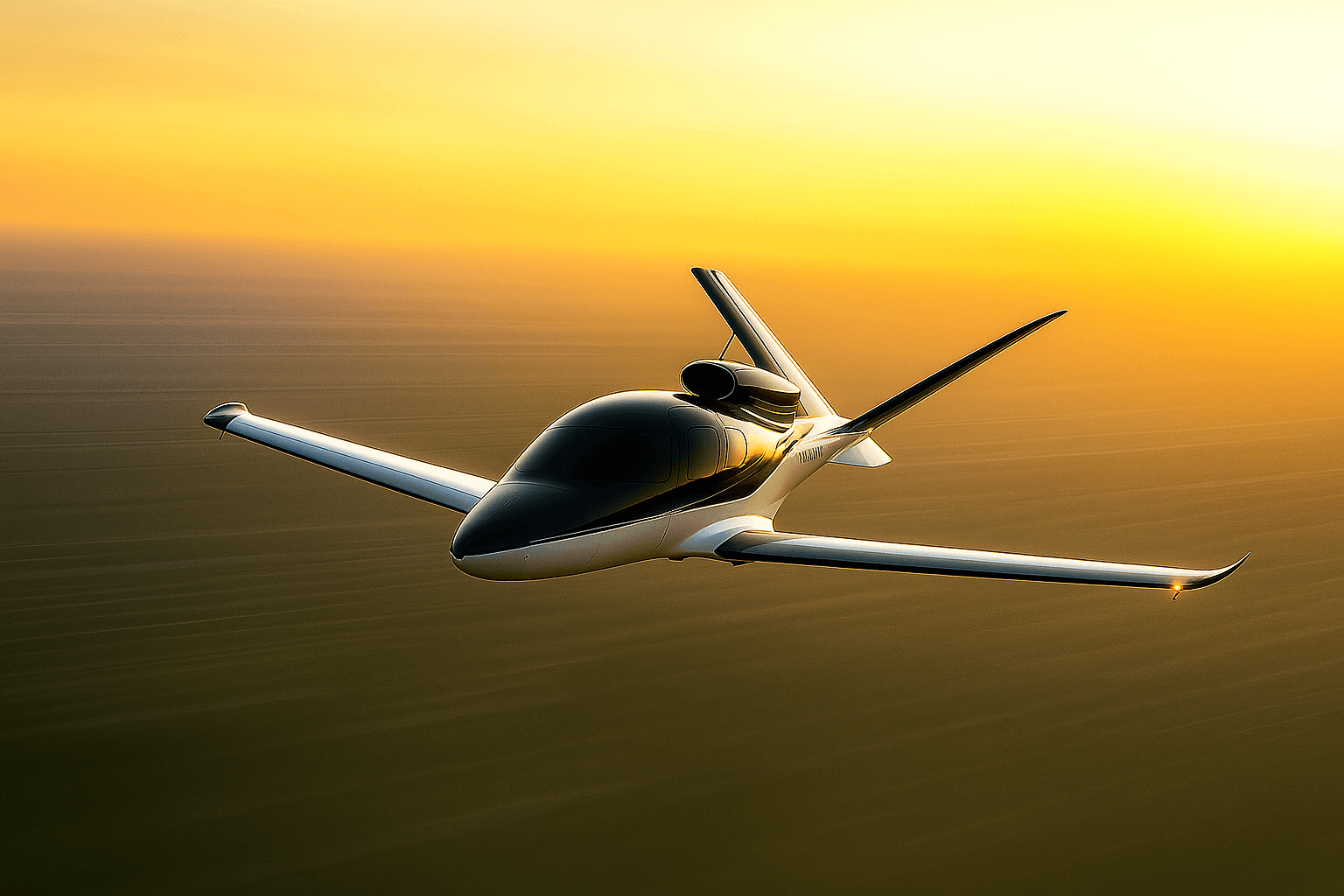

As the chairman of Flyte, the collapse of Verijet, once considered a rising name in sustainable private aviation, signals a turning point for the industry. Its Chapter 7 bankruptcy filing in the Southern District of Florida tells a familiar story in emerging sectors: rapid growth that outpaces financial control. Verijet’s assets, including its Cirrus Vision Jet fleet and unfulfilled customer contracts, are being liquidated. The lesson is simple. Ambition alone cannot sustain a business.

At Creatd, Inc., we see this as a chance to show how a different kind of aviation company can succeed. Through our subsidiary Flyte, we have built a model centered on structure, technology, and measured scalability. This combination allows us to grow while maintaining the integrity that others in the industry have lost.

From Expansion to Execution

Private aviation has spent the past five years in a period of aggressive expansion. Demand spikes during the pandemic, combined with cheap capital and the appeal of “green aviation,” led many operators to grow faster than their systems could handle. Verijet thrived during that cycle but could not sustain the momentum once costs rose and liquidity tightened.

The current environment rewards companies that can execute with discipline rather than promise endless growth. Flyte was designed for that reality. Instead of chasing size, we built infrastructure, logistics tools, and cash management systems that make scaling sustainable. We operate with the understanding that stability, not speed, determines long-term success.

Flyte’s Strategic Positioning

Flyte operates under an FAA Part 135 certificate using a model that focuses on efficient use of assets rather than asset accumulation. Instead of trying to own as many planes as possible, we use technology to maximize utilization. Our AI-powered scheduling and dynamic pricing systems reduce idle time and improve profitability per flight hour. This allows Flyte to grow efficiently while maintaining service quality.

As Verijet’s assets enter liquidation, we see opportunities to integrate routes, personnel, and infrastructure that align with our mission. Each potential acquisition is evaluated carefully. We are not driven by speed, but by fit and financial sense.

"We’re not celebrating anyone’s downfall,” I said recently. “But the industry needs a reset. Flyte was built on lessons from others’ mistakes. We believe in structure, accountability, and technology that works. We are ready to step in where Verijet left off with a model that lasts.”

The Post-Verijet Opportunity

Verijet leaves behind a network of customers, creditors, and skilled professionals who still believe in regional private aviation. Flyte is open to constructive dialogue with these stakeholders. There are strong assets worth preserving, and we intend to identify and integrate those that add long-term value.

“We’re not shy about absorbing parts of this business,” I added. “If there’s value in aircraft, routes, or people, we’ll look at it. The plan is simple. Bring the right assets under Flyte, keep the best people flying, and do it with the financial discipline that Verijet lacked.”

At its peak, Verijet was the 13th-largest private jet operator in the United States. Its decline demonstrates that scale without financial structure is unsustainable. Flyte’s model is designed to prevent that kind of imbalance.

Our three operating divisions—Flyte Luxe, Flyte Hops, and Flyte Escapes—address different segments of the travel market while sharing the same operational backbone.

Flyte Luxe provides private charter and executive services.

Flyte Hops operates regional commuter routes.

Flyte Escapes focuses on curated travel experiences that connect lifestyle and air mobility.

Each division is structured to be profitable on its own, ensuring that growth is supported by real demand rather than projections.

Balancing Vision with Financial Reality

Over the past decade, many aviation companies have tried to position themselves as innovators without proving they could sustain profitability. Flyte is taking the opposite approach. We focus on financial discipline first, allowing innovation to emerge from a position of strength.

“There is no room left for smoke and mirrors,” I said. “The next generation of aviation companies must balance vision with financial reality. We are building something that lasts.”

Our philosophy is that growth should be deliberate and data-driven. We measure success not by how much capital we raise but by how well we allocate it. Flyte’s strength comes from controlled execution, not marketing promises.

A Path Forward

The fall of Verijet is not the end of innovation in private aviation. It is the beginning of a restructuring process across the industry. Operators are realizing that the fundamentals matter again: reliability, profitability, and customer trust.

Flyte stands at the center of that shift. We are committed to building a modern aviation company that combines technology with operational precision. Our team understands that private aviation is no longer about showing off luxury. It is about designing efficient, scalable systems that meet real demand.

By learning from the industry’s missteps, Flyte is positioned to take advantage of a new landscape. We are expanding intelligently into Florida, the West Coast, and New York, regions where demand is steady but under-served. We are evaluating opportunities that fit our model, including routes, partnerships, and select acquisitions that can be absorbed without disrupting our balance sheet.

Flyte’s growth strategy is built on patience and precision. We do not believe in building for the sake of appearances. We believe in building for endurance.

Conclusion: Reconstructing an Industry

Verijet’s bankruptcy is a clear warning. Growth without structure collapses under its own weight. The next generation of aviation companies must understand that sustainability is not just environmental, it is financial and operational.

Flyte represents that evolution. We are not chasing headlines. We are building an aviation platform that is sustainable, transparent, and scalable. By aligning technology with governance, we can rebuild trust in private air travel while setting a new standard for performance.

The private aviation market is entering a period of realignment. The companies that survive will be the ones that combine creativity with structure. At Creatd, that principle defines every business we build. Flyte is simply the next example of how disciplined innovation creates lasting value.